With your Christmas credit card bills coming in, you may be wondering how you can pay them. Alternatively, you might not have any debt to pay down, but you want to save for a special trip or some other expensive item. As a family you can save money, by following my tips below.

Babies

Babies are said to be the most money-consuming members of the family. They come into this world with nothing on their backs and have needs - expensive needs. According to Canadian Living, children cost $243,660 to raise them to age 18. TD Canada Trust says that a baby's first year can cost you about $8000! There's no way around it, babies have expenses, but there are ways you can decrease these expenses.

Breastfeed! I am a breastfeeding advocate and breastfed all of my children into toddler-hood (and beyond). At $20 - $30 a can, formula is insanely expensive. Breastmilk is free. You also don't need to buy an expensive breast pump, unless you will be away from your baby for long periods of time. You won't need bottles, sterilizers, nipples and all that jazz. You don't even really need a breastfeeding bra, but it does help. If you are having trouble getting the hang of breastfeeding, see a lactation consultant, which are free at most hospitals. If you'd rather go for private services, there are some amazing ones and it will be money well-spent. Jack Newman (known as the guru of breastfeeding) has some links to check out.

When you are buying gear for your baby, check out places like Walmart for cribs, furniture and more, because that's where you'll find the best deals, as I have found. Sure, that $2000 sleigh crib is gorgeous, but who really cares? I would save your money and invest in a high-quality mattress. As for bedding, bumper pads are a no-no, blankets are a no-no, so why spend a few hundred dollars on a full set because it is cute? That was my mistake with my oldest son - out of the entire set the only item that got used was the sheets, and I could have bought those for much cheaper. I would instead get something like the SwaddleMe from places like SnuggleBugz, which are super handy, keep the baby warm and actually help them sleep better.

After feeding, your biggest expense is diapers. If you are planning to go the disposable route, I suggest buying the cheaper brands over the big name brands like Huggies and Pampers. You will probably have to try a few brands out to see what works for your baby, but I generally found the President's Choice brand to be exactly like Pampers and much cheaper. Cloth diapering is a good option too, but some argue that it is not necessarily cheaper. It can be if you choose to go with the diapers you stuff yourself, or you make them yourself. The Cloth Diaper Shop breaks down the costs of both types of diapering.

When you have your first baby, you want to put that baby in every baby gym, baby music and baby literacy class there is. Don't! These classes are usually majorly expensive and your baby will be none the wiser. Usually, putting your baby in these classes is more for you than the child. If you want socialization and stimulation, try to find free playgroups in your area. I have been going to these since my first child was four weeks old and eight years later, I'm still fond of them. In Ontario, the Ontario Early Year's Centre has satellite playgroups plus free programs at their centres and all of the moms I know would not have made it through those early years without these services.

As for the rest, I'd invest in a good-quality stroller, carrier and car seat - don't skimp out on these items or you might regret it.

Kids

Kids know how to eat money like they know how to eat all of the chocolate out of your purse. There are ways to limit your spending on kids.

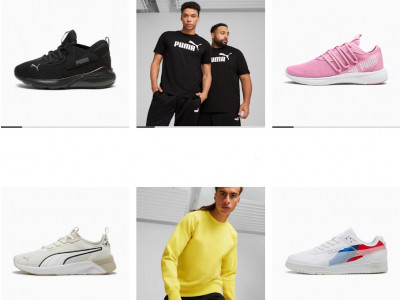

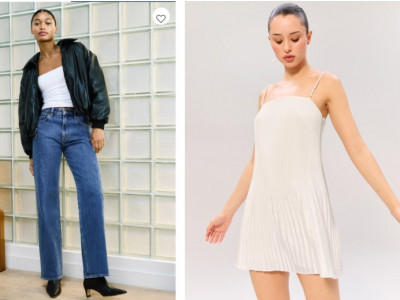

Clothing is a huge expense in my home, even though I have three boys. I hand down everything I can, but as they get older and dirtier and rougher on their clothes, my youngest often needs new clothes anyway. Still, I am always keen to accept hand me downs. Never say no to these. Most kids don't care if they are in style or just dressed. There are also brick & mortar stores and online stores like Minitrade that sell used kids clothing and let you sell your used clothing. We often have coupons for this store in our coupon forum. As always, checking Bargainmoose for sales is a great way to save too.

As for food, they need to eat, but they don't have to eat a bunch of packaged foods, which go down easily, keep people hungry and have you craving to buy more. Check out How To Save Money at the Grocery Store for tips on saving money on groceries.

I recently went to our local indoor playground after a mom of my son's friend said "little ones" get in for half price. It cost me almost $30 for the two hours my kids played and I felt totally ripped off after finding out little ones means kids three and under, and they are only $4 anyway. My big kids were $10 each to get in. Heather blogged great ways to entertain your kids cheaply and I'm going to start following her advice.

Kids, unlike babies, do need to be in structured programs for their health and well-being. I spend a big portion of my budget on activities for my children, but I did a lot of research first. My older boys are in karate and while some might balk at what I pay to the dojo every month, I find it well worth it because we love the program, the classes are unlimited and my boys are working towards a goal of getting their black belts. We started off on a Groupon with that karate company, just to see if the kids liked martial arts and if this was a place we wanted to spend our evenings. I suggest not going full out and signing a one-year membership for something you won't inevitably commit to. Always try to take advantage of free trials or deals to try it out before you buy. We also get discounts on the second and subsequent people who get a membership there, so it was much more cost-effective (and a time saver) to have all of my boys in karate, rather than a bunch of separate activities. I also plan to work toward getting my black belt there in the future.

Don't forget to take advantage of any tax benefits you get for raising kids. These can save you lots of money in taxes and can include the Children's Fitness Tax Credit, Universal Child Care Benefit and Canada Child Tax Benefit. If you are saving for your child's education, there are also available credits for that too. Just remember the old adage that says you should save yourself first, then your kids. Your kids will not support your through retirement just because you paid for their schooling. Saving in your RRSP first is much more important and the tax credits for that are seen now, not later.

Mom

Being a mom of three, I rarely spend on myself. When I shop for clothes, most of the time, they aren't for me. I still have bras from 15 years ago in my drawer. Saving on clothes is easy for me because 1) I don't really buy any 2) I accept hand-me-downs from friends and my mom 3) I write for Bargainmoose and know where and when to get the best deals. Besides that, you can save money on clothing too. Host a clothing swap with your friends. Most of us probably have a ton of clothes sitting in storage waiting for us to get back to that size we will never again be. If they are good-quality clothes in gently used condition, I'm sure you have a friend that would fit into them, so put your jealousy away and pass on the clothes. That said, you probably have a friend in the same predicament with your size waiting in bins, too. Oprah knows how to host a successful clothing swap, and now you do too.

Getting beautiful is probably a mom's biggest expense, what with hair care, makeup, skincare, nails, body hair, massages, and the list goes on and on. Check out our Bargainmoose article on Beauty on a Budget for tips on saving money in these departments. I have pretty low-maintenance hair, but it does have highlights and of course needs a trim every now and then. I begged my friends who have wonderful hair to tell me who they go to and just like that I found a hair stylist who works from home and therefore charges much less, and she is awesome. This goes for all of the departments I mentioned - most of the time, finding someone who works from home will cost you much less than going to a salon.

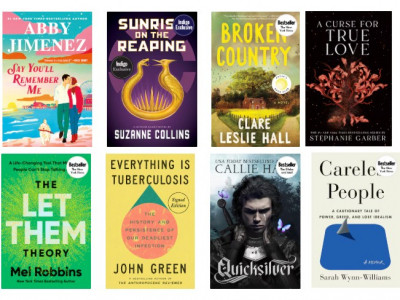

In your spare time (yes I know you are a mom, spare time is probably a luxury), you might have some hobbies. One of my best ways to relax is with a bottle glass of wine, a hot bath and some reading material. For the reading material, I used to buy books or magazines, but this gets expensive. Next Issue has unlimited magazines for a low monthly price. I just need to watch I don't drop the tablet in the tub. As for the wine, this also gets expensive if I'm drinking a bottle glass each night, so making my own wine is a great option too.

Dad

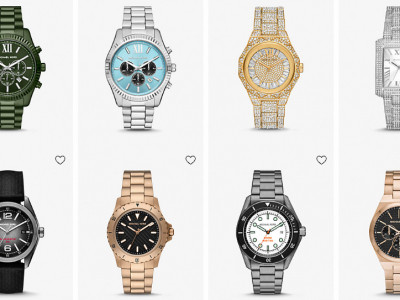

My husband doesn't really buy clothes, beauty products or participate in hobbies. He mostly works or hangs with us (poor sucker), but that's what he likes to do, so why not? He does really enjoy golf in the summer, and that can get very expensive. The best thing I found with this is for him to get a membership at a local golf course, and this goes for any sport. If the time is there, instead of going once or twice a month for $100 a round, get a membership and enjoy yourself more often, for less money. That said, my husband has a gym membership he never uses and we pay every month for this, and it is so wasteful. If you know there are any activities that you have signed up for but don't use, cancelling them will save you more money than you know.

My husband does like to hang with his friends, but it can get expensive for him as he buys rounds of drinks, takes cabs and always comes home with empty pockets. He should have a look at my articles about partying like a rock star without spending like one for both going out, or staying in.

If Dad is a gamer, our local tech blogger Shawn always has the latest info on the best deals on games, free games and apps and pretty much anything to do with the gaming experience.

Time Together

Time together as a family is so important, but it doesn't have to cost money. My family loves to play board games, most of which Santa brings as Christmas presents each year, and this is a very affordable way to spend time. I love to have new and updated family photos together, but can't always afford a professional photographer, and you don't always need one. As well, marriage takes a lot of work (a lot!), so my husband and I try to make time for each other do things other than argue about bills and kids, and again, it doesn't have to cost a lot, like I outlined in my seven frugal date nights article.

Bargainmoosers, what are your favourite ways to save as a family? Let me know!

(banner image credit: normalityrelief)

Comments