Impulse spending can happen anywhere there is a cash register. Sometimes you go to the store with the best intentions, and come out dropping an extra $100 more than you expected. If you ever have trouble curbing those impulse purchase choices, check out some of the tips I use below to keep my spending in check.

Have A Cooling Off Period

When I am in a store and pick up an item I was not planning on buying, I try to keep the item in my hand rather than placing it in the cart. As I walk around the store and I see other items I need, I compare it to the item in my hand. I often find that the item in my hand has lost its appeal before the end of the shipping trip. When I begin to hear any doubt in my head about the item, I immediately find a way to put the item back and walk away. If I had placed this item in my cart, chances are slim that I would have put the item back on the shelf.

This technique can also work with online shopping. Before I hand over my credit card information, I often walk away for at least a few hours. Sometimes I forget the items are in the cart. Other times when I come back, I pull several items out before purchasing. Even better, many stores will send you a reminder e-mail that includes a small coupon code to entice your to purchase.

I am not alone in abandoning my cart. According to Business Insider, over $4 trillion dollars of virtual merchandise will be abandoned in online shopping carts this year. While this technique will not work for deep discount deal items that sell out quickly, I find it very effective in curbing my spending habits.

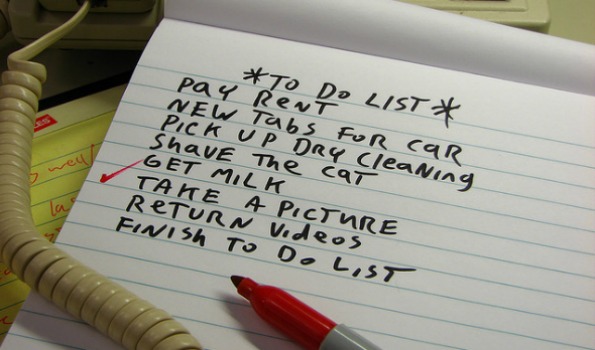

Keep A List of Things You Need

Most people keep some kind of running grocery list, but a running list can work well for any purchases. Check out this roundup of free organizational printables from The Country Chic Cottage. This free roundup includes gift buying lists, monthly budget lists, meal planning checklists and much more. Keeping yourself and your household organized will help you purchase with confidence when an item is a good deal.

Buy Items You Can Return

When faced with an impulse buy, stop for a few minutes and think about the return policy on the item. If you are online, you can often check the return policies at the very bottom of the website. When in the store you may want to reconsider your purchase if you cannot return it.

I have several retailers that I am hesitant shopping at because of the return policy. Every time I have tried to return something at Canadian Tire, it is a hassle. Canadian Tire’s return policy states that to receive a refund you must have the original receipt, be within 90 days of the purchase date and the item must be unopened. I have had trouble with clerks claiming packaging is open even when an item was unopened, and refusing to return the item.

Costco has a very consumer friendly return policy. Costco will issue you a credit if you have no receipt, or a refund within 90 days of purchase if you have a receipt. They have a 100% satisfaction guarantee for most of there products and I have never been hassled returning anything. Research the return policy at your favourite stores carefully before you purchase.

Evaluate The True Value

I once had a friend who had a side job at a retailer folding jeans racking up $10 per hour. When she was shopping for something new, she always evaluated the item based on how many hours of folding jeans it took her to earn the item. For example, she would consider if a new pair of shoes that were $50 was worth folding jeans for five hours. Similarly is a new $439 iPad Air worth 44 hours of folding jeans, or would the iPad mini at $280 accomplish the same tasks for only 28 hours of folding jeans.

You can calculate what your own personal time is worth also. Over at The Simple Dollar, they have a great post discussing one strategy for calculating how much your time is worth. This is a great mental technique to use for sale items where your time to buy is shorter.

Managing Your Kid's Impulse Requests

Like most parents, I try to limit the amount of sweet treats I bribe reward my daughter with when shopping. In turn, she has become a champion at spotting free samples. Sometimes if she has been good on a long shopping trip, I will swing through Tim Horton’s and order her one Timbit and a small coffee for me. When I have mentioned this to friends, I have found most folks think you must buy Timbits by the box. At twenty-five cents per Timbit, it is a great little treat without spending much money. If it is a crazy day, I buy two. ;)

Managing impulse spending can be a tough lesson for both kids and adults. It is hard to avoid the temptation of throwing extra items in the cart. Eva has a great post about Teaching Your Child The Value Of Money that has some great additional tips.

Bargainmoosers, what do you do to curb impulse spending?

(Image Credits: Gemma Bou, Great Beyond, Satya Murthy, Geoffery Kehrig)

Wow, these things are great!